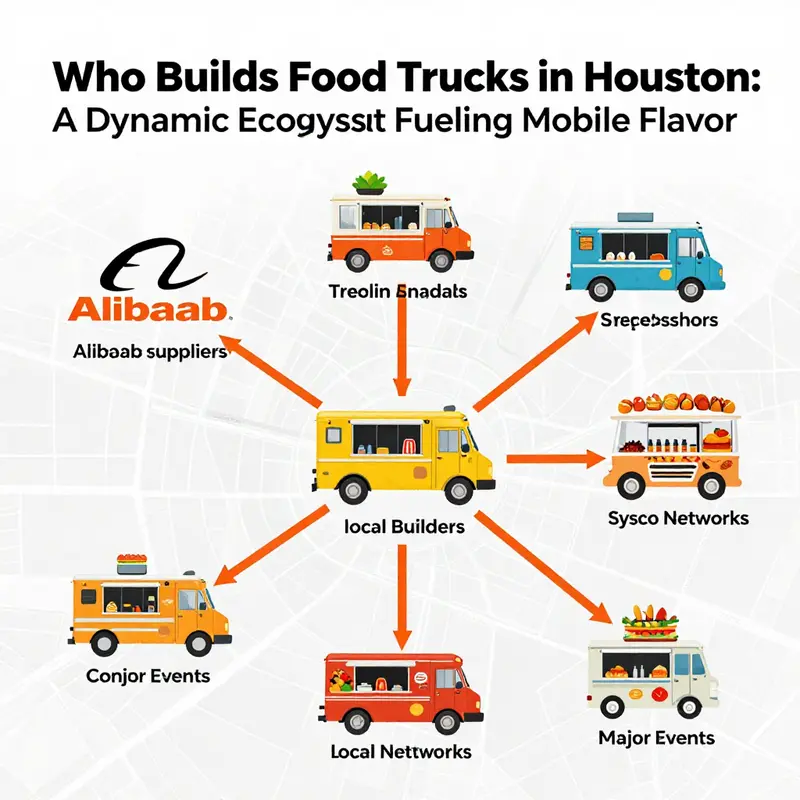

In Houston, the journey from idea to roaming kitchen is a tale of connections, opportunity, and hands-on craftsmanship. Buyers crave customization, reliability, and quick access to equipment and vehicles that can handle sizzling Tex-Mex, spicy Cajun, or bold fusion concepts. Suppliers seek scalable production, predictable quality, and partners who understand regional tastes and events. On one end, Alibaba.com serves as a broad marketplace linking buyers with manufacturers and custom builders who tailor trucks to almost any specification. On the other, Sysco anchors the market with its deep supply networks and a growing retail footprint, reminding us that the city’s mobile vendors depend on a robust distribution backbone. Between these forces are Houston’s own manufacturers and boutique builders who translate design dreams into road-ready rigs, whether for a brand-new build, a pre-owned unit, or a retro-inspired setup. The result is a thriving ecosystem where event planners, corporate teams, community groups, and food enthusiasts can collaborate with confident partners. This multi-chapter look will unpack five critical angles: the Alibaba marketplace as a nexus between buyers and suppliers; Sysco’s influence and the local infrastructure; the role of local manufacturers and custom builders; opportunities across new, used, and retro trucks; and the broader market dynamics driving sustained growth for mobile vendors. Each chapter ties back to how Houston makes mobile dining not just possible, but vivid, accessible, and rooted in community.

Chapter 1: Who Builds Food Trucks in Houston — The Global Marketplace as the Nexus Between Buyers and Suppliers

Houston has long been famous for its culinary energy, but the city’s ability to turn that energy into mobile kitchens depends on a broader, quieter infrastructure. The actual fabrication of new mobile kitchens rarely happens inside Houston’s city limits; instead, the city acts as a strategic hub, a gateway that connects local operators with a global network of builders and suppliers. In this system, a Houston operator can begin with a concept or a set of specifications and, through a global sourcing channel, access manufacturers that specialize in vertical integration: design, welding, powder coating, and final assembly all under one roof. The result is a streamlined production cycle that supports rapid scaling and customization without forcing a local operator to shoulder the full burdens of domestic fabrication from the outset. This arrangement has reshaped how new fleets come to life in Houston, allowing first-time operators to test ideas with lower upfront risk while established brands can expand their footprints more quickly than ever before.

The essence of this procurement model rests on a simple but powerful premise: a global marketplace can align cost, speed, and quality in a way that local builders alone cannot. For Houston buyers, this means access to a broad spectrum of configurations and finishes, from kitchens tailored to specific cuisines to chassis and chassis-mounted equipment selected to fit unique layouts. In practice, the supply chain often routes through industrial zones in other countries where manufacturing is highly specialized. Here, many facilities operate with integrated workflows—design teams, welding shops, coating lines, and final assembly crews all coordinating to deliver a ready-to-operate unit. The advantages are tangible. Production cycles can be dramatically shorter when multiple steps are under one roof, and the ability to customize at scale allows a shop to offer more variations in a shorter time frame. Most suppliers in this model report capable lead times that typically fall within the 25–40 day window for configured units, with ocean freight adding roughly three weeks to reach U.S. ports serving Houston and nearby coastal hubs. This cadence makes it feasible for operators to plan multi-unit rollouts with confidence, especially when matched with a steady pipeline of orders from growing brands.

Cost dynamics are equally compelling. Operators who leverage a global marketplace can achieve meaningful savings compared with domestically produced units, with estimates commonly quoted in the range of 20–35 percent, particularly when standard layouts are chosen or when orders encompass multiple units. Those savings matter not only at the point of purchase but across the life of the fleet, influencing decisions about financing, resale value, and maintenance planning. Yet the marketplace is not a blind bargain. It offers a wealth of information that helps buyers mitigate risk. Detailed product specifications, supplier performance data, and ratings become essential tools for operators managing strict launch timelines and multi-unit commitments. Buyers often weigh factors such as a supplier’s responsiveness, communication efficiency, and post-sale support capabilities—factors that are critical when logistics are complex and the margin for error is small. The digital nature of the marketplace facilitates due diligence in ways that traditional bidding may not, enabling operators to compare options side by side and to request references or sample configurations before committing.

Within Houston’s larger food ecosystem, the role of national distributors and regional supply networks adds another layer of complexity and resilience. The city hosts a robust distribution infrastructure that serves as the backbone of mobile food operations. A major local distributor of food-service products, with deep roots in logistics and cold-chain operations, helps ensure that mobile kitchens can be stocked efficiently and that their on-board systems stay within health and safety standards. While these distributors are not manufacturers, their presence shapes the procurement landscape: better access to reliable, compliant equipment and parts; smoother maintenance cycles; and clearer pathways for regulatory compliance. This synergy between the marketplace’s global reach and the local distribution backbone is what gives Houston operators the confidence to pursue ambitious growth plans, from single-carrier launches to multi-truck rollouts across neighborhoods and events.

For operators evaluating how best to proceed, the decision often boils down to balancing speed, cost, and customization. Domestic builders still occupy a vital niche, particularly for high-end, highly customized units that require on-site fabrication insights, specialized engineering, and a local warranty and service network. In Texas, there remains a steady demand for boutique builds that emphasize craftsmanship, precise fit and finish, and rapid on-site support. Houston and its nearby metros serve as both a market and a test-bed for these premium configurations, where operators can partner with local teams who understand regional tastes, permitting, and inspection requirements. This coexistence between global sourcing and local craftsmanship has proven durable, allowing new entrants to test ideas with modest upfront costs while experienced operators can push the envelope on design and performance.

The journey from concept to quipped-up kitchen on wheels often begins with a clear vision of what the unit must deliver—kitchen workflow, power and water needs, refrigeration loads, and the safety features that will keep both staff and customers secure. The marketplace offers a wide array of options for configuring these systems. While the core layout remains a recognizable blueprint—kitchen zone, service window, and customer-facing front—each operator can push for a unique footprint that fits their cuisine, footprint constraints, and event strategy. As buyers in Houston imagine their fleets, they frequently consider modular approaches that allow for easier swaps or upgrades in the future. Such flexibility helps operators respond to shifting demand, whether a neighborhood festival requires extra grill space or a weekend pop-up needs a rapid reconfiguration to support cold brew and pastries alike.

The narrative of Houston’s mobile-kitchen supply also includes a practical emphasis on education and due diligence. The market has matured to provide accessible information about compliance with health and safety standards, load testing, and post-delivery service plans. Operators are encouraged to verify that suppliers can support ongoing maintenance, spare parts supply, and responsive after-sales service. In a market where uptime translates directly into revenue, the peace of mind that comes from knowing there is a reliable service network can be as valuable as the unit’s flavor profile. Those who navigate this landscape well tend to combine a strong initial design brief with a disciplined selection process, drawing on the marketplace’s data-rich environment and on the local ecosystem’s capacity for execution.

For readers exploring practical next steps, a concise bridge exists between planning and action: consider how a given model will fit your cuisine, service cadence, and event calendar, and then verify the sourcing pathway that can scale with you. The decision is rarely binary; it is a calibrated blend of global capability and local support. If you are weighing configurations, you can learn more about choosing the right model through resources that discuss how layout, equipment, and workflow influence throughput and staff ergonomics. This kind of guidance complements the purchasing strategy and helps ensure that the fleet you assemble in Houston remains durable, compliant, and capable of delivering consistent quality to customers over time.

In this chapter, the story is less about a single builder than about a network—the network that allows Houston operators to imagine, source, and deploy fleets with a pace and precision that once felt out of reach. The global marketplace acts as a conduit, linking the city’s culinary ambition with manufacturers that can scale, adapt, and deliver. It also invites a broader perspective: as Houston’s street-food culture continues to evolve, the way its kitchens travel—from factory floor to curbside—will continue to reflect a shared belief in ingenuity, resilience, and the power of collaboration. For readers who want to dig deeper into model choices and layout strategies, you can visit the guide on choosing the right food truck model. Choosing the Right Food Truck Model. As you explore, remember that the best choice balances speed, cost, and craftsmanship, while keeping an eye on the logistical realities of a city that never stops moving. External resources and official guidelines further illuminate how operators can align procurement with health standards and regulatory expectations, ensuring that every wheel-turn in Houston’s mobile-kitchen ecosystem is also a step toward sustainable growth. For those seeking broader context and best practices on sourcing and regulation, consult the official operator guide that analyzes the Texas landscape and the ways different suppliers meet state health and safety requirements. External resource: https://www.texas.gov/foodtruck-suppliers

Chapter 2: Built on a Local Grid: How Houston’s Food-Truck Builders, Sysco’s Reach, and a Citywide Supply Network Shape the Market

Houston doesn’t rely on a single craftsman to turn a kitchen on wheels into a business. It runs on a distributed, interwoven system where global sourcing, local fabrication, and infrastructure all press inward to shape what a truck can be, how it operates, and who can afford to put it on the street. The city’s appetite for mobile food is matched by a network that includes online marketplaces, regional distributors, and a constellation of local builders who customize, repair, and upgrade fleets for operators who move from neighborhood to neighborhood with the heat and humidity riding along in the cab. In that sense, Houston’s truck culture is less about a singular brand than about a citywide grid of capability, logistics, and governance that makes mobility practical, scalable, and, above all, persistent in a market that never truly sleeps.

On the sourcing side, platforms that connect buyers to manufacturers have become a central feature of the Houston scene. Alibaba’s marketplace model, in particular, has introduced buyers to a spectrum of configurations that can arrive as turnkey, fully equipped units or as shells ready for a Houston customization. The listings describe mobile combi food trucks with kitchens, refrigeration, and design options that range from modern to retro, along with pre-owned and used trucks and trailers, including carts for hot dogs and coffee setups. The practical effect is that Houston operators can pair a chosen chassis with equipment tailored to a specific cuisine, energy needs, and service style. This flexibility helps a buyer fit a limited startup budget into a long-term plan, while allowing a more established operator to refresh a fleet with newer technology, better ventilation, or more efficient layouts. Yet the absence of a single dominant builder underscores a broader truth: in Houston, value comes from the ability to mix and match builders, equipment lists, and design philosophies into a truck that feels uniquely suited to a specific lane, a particular block, or a cherished neighborhood.

That mosaic is reinforced by the city’s powerful distribution ecosystem. Local distributors move more than groceries; they move confidence, spare parts, and even the know-how that keeps a kitchen on wheels compliant, clean, and efficient under pressure. Sysco’s footprint in the region, while not a truck manufacturer, is a reminder that the market’s backbone is often invisible at first glance. The company’s expansion into retail—such as the conversion of a large store into a community access point for foodservice products—highlights how a robust supply chain can extend beyond restaurants into mobile concepts. For operators, this means easier access to ingredients, connectors, and the tools needed to keep a truck on the road. The broader implication is that the path from a chassis to a thriving stall is mediated by a network that includes not just builders, but an ecosystem of suppliers who understand the peculiar rhythms of Houston’s climate and its hours of operation.

To understand why that matters, consider the regulatory and logistical realities that shape a mobile kitchen in this city. Houston’s sprawling footprint makes parking, permits, and health-code compliance a practical hurdle rather than a mere formality. Street-front setups, event-driven pop-ups, and fixed-location concessions all share the same basic needs: reliable utilities, waste management, and a predictable supply chain. The city’s climate—hot days, sudden humidity, and heavy summer storms—also pushes truck design toward efficient cooling, air circulation, and robust insulation. Builders who understand this environment design kitchens with the Houston heat in mind, selecting materials that resist warping, hood systems that vent efficiently without excessive draw on a generator, and layouts that keep staff comfortable during long shifts. In short, the infrastructure isn’t just about where a truck parks; it’s about how a truck functions when it’s actually in service.

Inside that infrastructure, the role of local fabricators becomes particularly visible. Houston operators often blend new and used components, working with manufacturers and custom builders who can attach a tailored kitchen, a refrigeration suite, and a ventilation system that meets health codes while fitting a tight footprint. The customization process is a dance between the client’s culinary vision and the realities of Houston’s roadways and neighborhoods. The result is a truck that is not only a moving restaurant but a practical tool that can handle the city’s demand cycle—from weekday lunch bursts in office corridors to weekend crowds at street fairs and crawfish boils that only appear when the calendar points to spring. In this context, the builder is as much a problem-solver as an artisan, aligning equipment choices with expected volumes, ventilation needs, and the precise power and water hookups a site will provide.

The Houston market also reflects a deliberate separation of roles between the person who designs the truck and the person who operates it. New entrants may begin with a used shell and a set of precise specifications, then consult a local fabricator who understands the city’s electrical load, propane rules, and water supply constraints. Others start with a clean slate, selecting a modern, energy-efficient layout that prioritizes throughput and ease of cleaning. A key thread through all of this is the recognition that a successful mobile kitchen depends less on chasing the latest trend than on delivering consistent quality under variable conditions. The market rewards durability, ease of maintenance, and the ability to source replacement parts quickly—factors that traditionally push buyers toward a network of trusted suppliers who know Houston’s pockets of demand, the typical distance between pop-ups, and the best routes for a late-evening delivery of fresh produce or ice.

For operators seeking guidance, the regulatory terrain is not an obstacle to creativity but a framework within which the city’s food-truck culture can flourish. The path from concept to a fully operational unit involves planning around parking permissions, route allowances during city events, and the practicalities of obtaining health permits for a mobile kitchen. In this sense, the link between infrastructure and the daily life of a truck is intimate: electrical hookups, water supply, waste removal, and the ability to maintain temperature-controlled environments are all prerequisites that influence how a truck is built, where it can operate, and how often it can be on the move. Those who want to understand the regulatory landscape in more detail can explore resources like Navigating food truck regulations, which distill the practical steps operators must take to stay compliant across different districts and events.

Amid these dynamics, the question of “who builds the trucks in Houston” resolves into a story of collaboration rather than conquest. Alibaba and similar marketplaces connect buyers to a spectrum of builders who can deliver what a Houston operator needs, whether it’s a compact unit for a neighborhood festival or a fully equipped combi truck designed to handle a high-volume business near a major corridor. Then there are the Houston-based fabricators who bring a local touch: they understand the city’s climate, the typical service hours of busy districts, and the kind of service that keeps a kitchen running from sunrise to late night. This collaboration allows operators to loop in a variety of specialists—metal workers, electricians, HVAC technicians, and health-code consultants—without having to manage dozens of contractors. In a city that thrives on speed and variety, the ability to assemble a team quickly and responsively becomes a core competitive advantage.

Finally, the broader market picture makes one thing clear: Houston’s mobile-food landscape is a case study in how a city can support a thriving fleet of trucks not because a single seller reigns supreme, but because an entire ecosystem aligns incentives around reliability, customization, and access to resources. The builders bring visions to life; the distributors ensure that ingredients, parts, and equipment are within reach; and the city’s regulations and infrastructure shape how those visions operate on the ground. In this layered environment, success isn’t about picking a winner but about knitting together supply chains, design capabilities, and regulatory know-how into a practical, repeatable path to ownership and operation. As the market evolves, the ability to adapt—whether by swapping out a kitchen module for a larger capacity or by partnering with a local fabricator who understands the nuances of Houston streets—will continue to determine which trucks stay on the road and which ones are parked for good. For readers curious about the broader context of how a major distributor and a robust logistical network influence the mobile-food economy, exploring the Sysco landscape offers a useful lens into the supply-side dynamics that quietly power every successful Houston truck on wheels.

Chapter 3: Builders on Wheels—Houston’s Makers Shaping the Mobile Kitchen Landscape

Houston sits at an intersection where infrastructure, industry, and appetite converge to sustain one of the most dynamic mobile food economies in the region. The city’s vast network of highways, rail corridors, and deepwater ports creates a steady flow of materials, components, and talent that turns empty lots into fully functional kitchens on wheels. It’s not merely a matter of assembling a kitchen into a truck frame; it’s about orchestrating a seamless translation from concept to street, and doing so in a way that respects health codes, operator budgets, and the rhythms of a busy dining scene. In this environment, the builders matter as much as the menus. Their craft—rooted in metal fabrication, electrical systems, and finishing work—serves as the backbone of a growing mobile culinary culture. The Houston market rewards shops that can move quickly, scale with demand, and adapt to a menu’s evolving needs, whether the operator is testing a concept with a single vehicle or pursuing a fleet that can cover neighborhoods and events with uniform reliability.

Within this ecosystem, local manufacturers and custom builders perform more than mere assembly. They translate a chef’s dreams into dimensions, layouts, and equipment configurations that fit a truck’s chassis while meeting health and safety standards. Discussions often begin with kitchen flow: where the hotter stations sit in relation to refrigeration, how the prep area feeds into a service window, and how exhaust and ventilation can be integrated without sacrificing space. The process continues with welding and fabrication, where frames are reinforced, panels are mounted, and stainless enclosures are crafted to withstand the daily wear of a high-traffic kitchen. Finishes—powder coatings, decals, and branding elements—get applied to ensure a unit not only functions well but also communicates a brand story as clearly on the street as on a menu board. Because Houston operators frequently demand reliability and speed, builders here have honed the ability to move from sketch to closeout in tight timeframes, providing firmware-ready electrical panels and pre-wired refrigeration hookups that reduce on-site downtime.

The value of a Houston-built unit extends beyond the shell. Local teams understand the regulatory landscape and, more importantly, how to design with it in mind. State health and safety standards drive many decisions, so surfaces, fixtures, and storage solutions are selected with sanitation and ease of cleaning in mind. NSF-compliant components and surfaces that tolerate frequent washing become standard expectations rather than exceptions. This emphasis on compliance is not about bureaucracy; it’s about giving operators a defensible path to legal operation and a predictable daily routine. A well-designed truck can withstand front-line service—hot lines, grease management, and multi-service days—without sacrificing the workflow that makes a concept scalable.

But Houston’s market isn’t confined to domestic production alone. Its strategic position also makes it a bridge to global manufacturing networks. Overseas suppliers have built capacities that can deliver cost advantages for standardized layouts or multi-truck orders, enabling operators to realize substantial savings while preserving design intent. The appeal lies in the capacity to source a core footprint, select from a menu of configurations, and add enhancements that suit branding, climate, and local appetite. Delivery timelines can hinge on ocean freight, yet the math often remains favorable when spread across a small fleet or a growing concept. Even with transit time, units can be produced en masse and shipped to the Gulf Coast, where local teams finalize assembly, install fittings, and perform final inspections. This import model does not erase customization; it reframes it as a modular strategy—masters of the same kitchen in different shells, ready to hit the road with minimal friction and predictable quality.

A mature alternative, and often a prudent starting point for new entrants, is the used-truck market. The market for pre-owned trucks and trailers has grown more sophisticated in Houston, with specialized B2B suppliers curating selections from fleet decommissions, restaurant closures, and manufacturer overstock. These vehicles are reconditioned to meet baseline operational and safety standards, frequently featuring stainless steel construction and upgraded components where needed. For a first-time operator, the lure is affordability and speed-to-launch; for the experienced restaurateur, it is the opportunity to scale quickly without tying up capital in new builds. The critical task is to vet suppliers for reliability, responsiveness, and long-term support. In practice, a practical KPI emerges: response times. Vendors that reply within a couple of hours on urgent questions tend to keep launches on track, minimize paperwork bottlenecks, and reduce the risk of costly delays during opening weeks.

The Houston story blends local craftsmanship with the efficiencies of global manufacturing in a way that few markets can match. On one hand, there are shops that bend and blend metal with precision, install custom interiors, and deliver finish work that makes a kitchen feel polished enough for prime-time service. On the other hand, the proximity to international production lines means buyers can opt for a structure that uses standardized footprints and a flexible range of equipment selections, reducing price pressures while preserving the ability to tailor each unit to a specific concept. The city thus rewards savvy buyers who enter the market with clear specifications, a realistic project timeline, and a strategy for long-term support—whether they are starting with one truck, expanding to a small fleet, or building a citywide presence that spans events, neighborhoods, and a rotating menu.

The practical implication for operators is straightforward: identify the path that aligns with your concept’s scale, budget, and branding, then select partners who demonstrate a disciplined approach to design, fabrication, and aftercare. It is not a matter of choosing between local artistry and global manufacturing but of weaving both strands into a coherent plan. The right partner will ask for space, power, water, and permit considerations early, and will then translate those constraints into a kitchen that performs as reliably on a Saturday market as it does on a weekday lunch crowd. In a market where every service window is a chance to convert a guest into a loyal customer, the quality of the kitchen—the heart of the operation—becomes a defining factor in a brand’s survival and growth. For operators weighing domestic builds versus imported configurations, a practical starting point is to explore the model options and how they align with kitchen layouts by consulting resources such as Choosing the right food truck model. This kind of inquiry clarifies space needs, power demands, and equipment footprints, helping buyers avoid costly postpurchase adjustments and ensuring the kitchen can scale with demand.

No matter which path a buyer chooses—local craftsmanship, overseas production, or a mix of both—the Houston market rewards clarity, reliability, and a willingness to adapt. Builders who understand the flow of a kitchen, the cadence of city permitting, and the nuances of sanitation deliver more than a product; they provide a platform for a concept to live and breathe on the street. Operators who invest in a thoughtful, well-supported build set themselves up for not just a successful launch but a durable trajectory through Houston’s peak seasons and off-peak times alike. This is how a city with deep industrial roots becomes a living laboratory for mobile dining, where every chassis is a potential storefront and every fabrication decision is a step toward turning appetite into lasting enterprise.

External Resource: https://www.foodtrucksupplierguide.com/texas-manufacturers

Wheels of Enterprise: Houston’s Food-Truck Builders Across New, Used, and Retro Custom Creations

Houston sits at a crossroads of commerce, craft, and cuisine, where the demand for mobile kitchens meets a thriving ecosystem of builders and suppliers. Rather than a single supplier, Houston’s market offers a spectrum of paths—from all-new builds on current chassis to refurbished units that cut risk and cost, to retrofitted classics that foreground brand storytelling.

For operators seeking new builds, Houston and the wider Texas region host specialized manufacturers delivering fully compliant, NSF-certified kitchens. These producers offer end-to-end service: layout design, energy-efficient refrigeration, robust cooking lines, and waste management systems designed to meet health codes. The upside is a clean slate and a footprint that can be tailored to event schedules or outdoor configurations.

On the used side, pre-owned trucks circulate through fleet retirements, restaurant transitions, or pandemic-era offlines. Refurbishment specialists restore stainless steel integrity, upgrade appliances, and document performance and warranty coverage. A well-documented used unit can arrive with a warranty-backed refurbishment, tested electronics, and a transparent service history, delivering lower upfront costs and shorter lead times while enabling branding customization.

Beyond new and used, retro custom trucks occupy a distinctive niche. Local artisans transform vintage delivery vehicles into bespoke culinary stages that double as walking brand experiences. These builds require close collaboration, disciplined project management, and a readiness to blend retro fit tech with a modern kitchen core. Costs and timelines can be higher, but the result is a memorable, press-worthy platform that supports storytelling on wheels.

Houston’s proximity to Gulf Coast ports and metal fabrication hubs reduces material costs and speeds refurbishments, with the Dallas–Fort Worth corridor providing additional capacity. Operators often source across corridors to balance cost, schedule, and aesthetics, using digital marketplaces and direct conversations with builders to compare capabilities and timelines.

A savvy buyer weighs build path through a structured lens: long-term reliability and predictable maintenance with new builds; rapid market entry and reduced upfront risk with used trucks; or brand-driven, differentiated presence with retro builds. Clear specifications, transparent inspections, and timely financing align with revenue forecasts.

Welding Wheels, Wiring Markets: How Houston’s Food-Truck Builders Turn Global Supply into Local Flavor

Houston’s food truck scene rests on a quiet but intricate trail of builders, fabricators, and suppliers that span continents and coastlines. The city may not host a single dominant factory that churns out every chassis, kitchen, and grille, but it sits at a strategic crossroads where demand, capital, and regulation converge. In this ecosystem, the real builders are a mix of local refurbishers, regional suppliers, and international manufacturers who tailor their output to Texas’s distinctive market realities. The result is a marketplace that blends capital efficiency with practical reliability, a combination that has accelerated mobile culinary ventures across Houston’s diverse neighborhoods while keeping a lid on upfront risk and downtime.

At the heart of Houston’s near-term procurement landscape are specialized players who operate in the margins between new demand and secondhand supply. These are not traditional mass producers; rather, they are refurbishment specialists and knowledgeable B2B suppliers who source units through fleet decommissionings, restaurant closures, and manufacturer overstock. They take a used or partially built platform and recondition it to meet current standards. The process is not cosmetic; it is a thorough revamp that emphasizes compliance with the Texas Department of State Health Services (DSHS) standards, upgraded refrigeration and electrical systems, and reinforced structural integrity. For many first-time operators, this pathway offers a capital-efficient entry that allows rapid scaling to multi-unit runs without the long lead times associated with a completely new build.

What makes this secondary market work in Texas is the growing transparency that accompanies modern procurement. Digital trade channels now host verifiable performance metrics and documentation, enabling buyers to assess long-term reliability before committing capital. A buyer can, for example, review a unit’s sanitary compliance history, refrigeration uptime, electrical load specs, and the traceable service records that attest to a platform’s readiness for the demands of a busy Houston shift schedule. This level of visibility reduces procurement risk at a time when a launch window may be tight and the appetite for a fleet rollout is high. And while the immediate ecosystem is grounded in the domestic market, it is inherently international in its reach. The global supply chain that feeds Houston’s mobile vendors relies on a steady flow of components, appliances, and modular layouts produced far from Texas, yet configured to thrive in the city’s climate, regulatory environment, and commercial rhythms.

When buyers look beyond the refurbished segment, a broader geographic logic comes into view. Houston’s status as a major freight hub and its proximity to Gulf Coast ports position it as a practical gateway to international suppliers, particularly those based in Asia. In practice, vertically integrated manufacturers in China can deliver fully configured units on a schedule that aligns with Texas tax calendars and permit cycles. Typical lead times for custom configurations are in the 25- to 40-day range, followed by roughly three weeks of ocean freight to Houston or nearby Corpus Christi. For operators, this model translates into a compelling cost dynamic: a 20–35 percent cost advantage versus domestic builds when ordering standardized layouts or multiple units. The appeal is not solely price; it is speed and scale that matter in a market where trends shift with the seasons and the next neighborhood pop-up can materialize overnight.

These international suppliers benefit from China’s advanced automation, disciplined sourcing, and the ability to produce stainless steel, NSF-compliant kitchens at competitive prices. The Houston region’s deep metal fabrication expertise and mature service networks then translate these factory floors into a practical on-ground reality. The result is a pipeline that starts in a Zhengzhou or Qingdao factory, flows through ports, and culminates in a Houston lot with a truck bed already fitted for grease and heat, yet adaptable enough to accommodate a chef’s preferred workflow. In this sense, Houston functions less as a factory town and more as a distribution and service center where units are configured, maintained, and deployed to meet the city’s dynamic dining culture.

The regulatory frame further sharpens this balance between global supply and local performance. Health and safety codes shape both the design and the operational lifecycles of mobile kitchens. Responsible builders design with the DSHS Food Protection Division in mind from day one, ensuring that refrigeration, handwashing, waste management, and electrical safety all align with state standards. This regulatory gravity has a practical payoff: operators can scale with confidence, knowing each truck is equipped to pass inspections on the first pass and endure the rigors of Houston’s heat, humidity, and high-volume events. For readers seeking a concise reference on these requirements, the Texas Department of State Health Services maintains an authoritative repository on food protection and licensing that informs every stage of build, fit-out, and operation. External guidance is essential because it translates into real-world decisions about equipment choices, layout plans, and maintenance schedules.

Against this backdrop, the decision path for a prospective operator becomes a study in balancing speed, cost, and customization. Some buyers prioritize a fast entry and lean capital outlay, which makes refurbished platforms and tiered equipment packages attractive. Others pursue a white-glove approach, commissioning a modular build from an international manufacturer configured to Texas specifications, with the added assurance of long-term service agreements and readily available replacement parts. A healthy Houston market often features both strategies coexisting in adjacent blocks, each serving a slightly different customer segment while sharing a common objective: to deliver a reliable, scalable culinary platform that can stand up to the city’s competitive food scene. For operators wrestling with the choices between layouts, power configurations, and sanitary fittings, a practical navigation is available in the form of industry guidance that emphasizes the right fit for the intended menu, anticipated batch sizes, and the local permit regime. As a handy starting point, see the discussion on choosing the right food truck models, which helps align kitchen workflow with vehicle form factors and space constraints while maintaining compliance and efficiency.

Houston’s ecosystem also emphasizes ongoing maintenance and rapid repair capabilities, recognizing that the most critical moment for any mobile kitchen is the service window between events. Local refurbishers and service networks have grown adept at rolling trucks into a shop for a quick refresh or a major retrofit, restoring electrical integrity, upgrading refrigeration, and updating controls to match evolving health codes. This on-the-ground adaptability is what makes the city a magnet for mobile vendors who want to scale competitively without being immobilized by long downtime. The logistics underpinning this capability are straightforward: a robust network of suppliers and technicians, a steady flow of spare parts, and the physical proximity to key ports that keeps the whole system responsive to market shifts. In practice, this means a unit can be dispatched from a refurbished yard or a primary manufacturing hub, arrive with the expected sanitation and safety features, and be ready to fire up within days rather than weeks.

The story of who builds food trucks in Houston, then, is less about a single name or a single factory floor and more about a systemic choreography. It is a choreography that choreographs cost, speed, compliance, and customization across a transcontinental supply chain while anchored by a local ecosystem of refurbishers, fabricators, and service specialists who understand the city’s pace. It is a model built on transparency—of performance metrics, of documentation, and of regulatory alignment—that reduces risk for entrepreneurs stepping into a demanding market. It is also a model that keeps Houston’s mobile vendors flexible enough to respond to evolving tastes, festival calendars, and neighborhood demographics without sacrificing the reliability that first-time lenders and seasoned operators demand. In this sense, the builders are less visible than the trucks they bring to life, but their influence shapes the flavor and cadence of Houston’s streets, where a single afternoon’s queue can redefine a neighborhood’s culinary map.

For readers curious about the practical steps of choosing and configuring a truck, the linked guidance on selecting the right model offers a concise framework that complements this broader ecosystem perspective. See the discussion here for actionable considerations on layout, equipment options, and menu compatibility as you plan a rollout in Houston’s markets. And for a broader view of the regulatory environment that governs these operations, consult the official health and safety resources tied to state guidance, which anchor every decision from design to daily operation. https://www.dshs.texas.gov/foodpro/

Final thoughts

Houston’s mobile food landscape is not built by a single company alone but by a tapestry of platforms, people, and processes. The Alibaba marketplace unlocks access to a global array of manufacturers and custom builders who can craft exactly the truck you envision, while Sysco anchors the supply chain with essential ingredients, equipment, and retail innovation. Local Houston-based manufacturers and boutique builders translate design concepts into durable, climate-ready rigs tailored to city life, festivals, and neighborhood markets. And with a spectrum of options—from brand-new builds to pre-owned and retro-inspired carts—vendors can select solutions that match budgets, branding, and cuisine. The wider ecosystem—events, community groups, and corporate initiatives—amplifies demand and offers fertile ground for partnerships. For event planners, that means reliable partners able to deliver cohesive, on-theme experiences; for HR and admin teams, it means scalable concepts for site events and retreats; for communities and food enthusiasts, it means greater access to diverse flavors and experiences on wheels. The takeaway is clear: in Houston, the question isn’t just who builds a truck, but how a connected ecosystem makes mobile dining vibrant, adaptable, and deeply rooted in local culture.