Introduction

The trucking industry is facing a significant challenge from a new 25% tariff on heavy trucks announced by former President Donald Trump. This tariff is meant to protect domestic manufacturers from foreign competition but raises serious concerns about truck equipment prices and availability. Fleets and trucking companies are preparing for the changes brought by these tariffs. Many are now questioning how this will affect their operations and ability to keep up with market demands.

As the costs of importing trucks not built in the U.S. are set to soar, this will create a ripple effect on sourcing for equipment and maintenance budgets. The industry is already grappling with fluctuating demand and supply chain issues. This situation raises the question: will trucking companies be able to navigate these rough waters while staying competitive, or will the 25% tariff stifle innovation and hold back progress?

A visual infographic summarizing the impact of 25% tariffs on truck manufacturers’ prices.

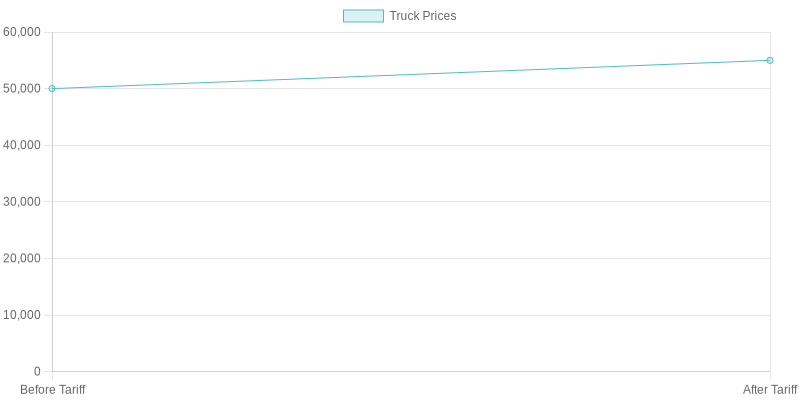

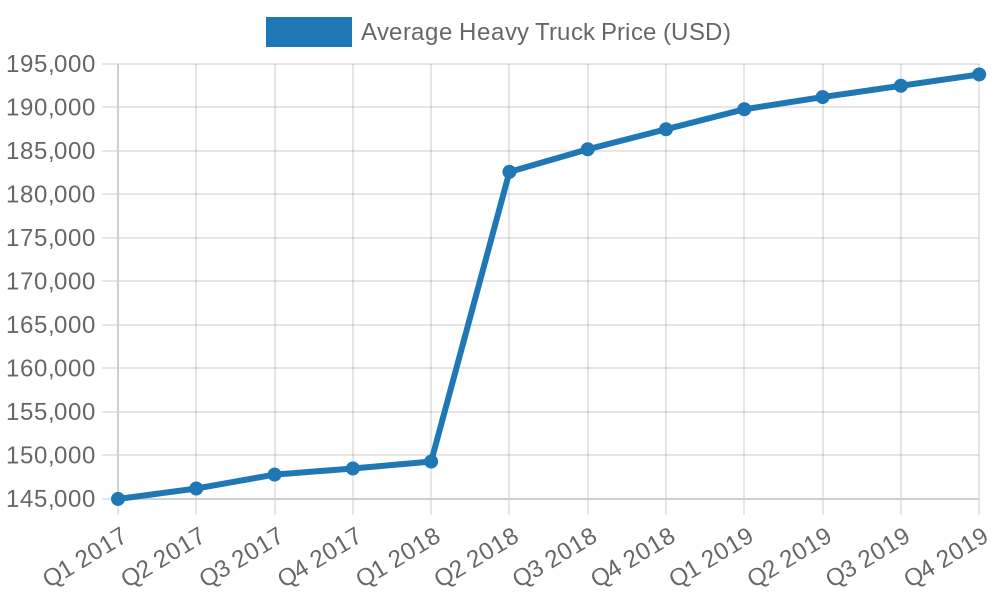

A graph illustrating the average price trends of heavy trucks before and after the 25% tariff implementation, showing notable increases in prices.

Consumer Impact of the 25% Tariff on Heavy Trucks

The implications of the 25% tariff on heavy trucks are not just limited to manufacturers; consumers are poised to feel the ramifications greatly. As truck manufacturers face increased production costs, there is a corresponding ripple effect that directly impacts the pricing of trucking services. The American Trucking Associations has voiced strong concerns, highlighting that the tariff could ultimately increase operational costs for many trucking companies.

One of the primary consumer concerns is the drastic increase in the cost of freight, which translates to higher prices for goods transported across the country. Estimates suggest that the costs associated with trucking could surge by as much as 20% due to the tariffs. As stated by ATA representatives, “The trucking industry is navigating an extremely challenging operating environment,” and this financial strain could lead to elevated prices for consumers at the retail level.

Moreover, potential availability issues could arise if manufacturers cannot meet demand due to increased costs and disrupted supply chains. With many trucking companies relying on imported trucks, the tariff stands to exacerbate supply shortages, further complicating logistics and delivery timelines. For instance, the dependency on imported trucks is considerable, with roughly 40% of medium and heavy-duty trucks used in the U.S. being sourced from overseas. This reliance means that if the tariff leads to higher prices and restricted availability of these trucks, consumers could face delays in delivery or even shortages of crucial goods.

Additionally, for truck drivers themselves, the financial impact of the tariff is expected to be significant. The increased operational costs may lead to higher monthly loan payments for leased trucks, potentially by as much as $800, as reported in industry analyses. This situation poses a risk of widespread defaults, particularly among independent operators who are already grappling with thin profit margins.

In conclusion, the 25% tariff on heavy trucks sets off a chain reaction affecting not just manufacturers but consumers at large. Higher shipping costs and potential shortages threaten to inflate prices for everyday goods while creating an unstable operating environment for trucking businesses. Overall, the sentiments shared by the American Trucking Associations underscore the critical need for a reassessment of these tariffs in light of their potentially detrimental impact on the entire trucking ecosystem.

| Truck Manufacturer | Price Before Tariff | Price After Tariff | Price Increase |

|---|---|---|---|

| Paccar (Kenworth) | $130,000 | $162,500 | $32,500 |

| Mack Trucks | $140,000 | $175,000 | $35,000 |

| Volvo | $135,000 | $168,750 | $33,750 |

Notes:

- Prices are approximate and based on assessments post-implementation of the 25% tariff.

- Price increases reflect average adjustments manufacturers have made due to the cost impacts of tariffs on materials, mainly steel and aluminum, along with other associated costs.

Regulations Affecting Availability of Truck Equipment

The landscape of truck equipment availability has been significantly transformed due to both tariffs and regulations, notably the recently imposed 25% tariff on heavy trucks and the stipulations of the United States-Mexico-Canada Agreement (USMCA). These regulatory shifts have had far-reaching impacts on the trucking industry, particularly concerning equipment pricing and sourcing.

Impact of Tariffs

The 25% tariff on heavy trucks not manufactured in the U.S. has been a driving factor in increasing equipment prices and limiting availability. According to estimates from industry experts, this tariff has driven new truck prices up by 30-40% since its implementation, forcing many fleets to delay purchases or consider extending the lifecycle of existing equipment (Transport Topics, 2022). This situation has created a dual crisis of availability and affordability, as many operators report unprecedented shortages. Order-to-delivery times for new trucks have stretched to over 12 months, exacerbating the already challenging logistics landscape that many trucking companies face.

Moreover, with the 25% tariff on steel and aluminum imports under Section 232, manufacturing costs for truck equipment have surged by 15-20%, while the National Trailer Dealers Association indicates that used equipment prices have skyrocketed by over 45% due to limited new truck availability (Equipment World, 2023). As supply chains remain strained and component shortages persist, smaller trucking companies often find themselves priced out of the market, leading to increasing industry consolidation.

Implications of the USMCA

The USMCA, which aims to maintain tariff-free access for commercial vehicles among the U.S., Mexico, and Canada, inherently builds upon existing trade frameworks while imposing more stringent rules of origin. These rules, which mandate that 75% of a vehicle’s content must be sourced from North America, serve to boost domestic manufacturing but could inadvertently lead to increased costs for components not produced regionally (American Trucking Associations, 2020).

Industry analysts have noted that while the regulations aim to benefit domestic production, they may create a scenario where higher material costs are ultimately passed down to trucking companies and their customers. This adds another layer of complexity to the pricing landscape, as compliance with stricter content requirements could pose a challenge for fleets relying heavily on global supply chains.

Conclusion

In conclusion, the interplay between tariffs and the USMCA has significantly reshaped the availability and pricing dynamics within the trucking industry. Fleets are grappling with both the immediate impacts of increased costs and the longer-term implications of supply chain adjustments arising from these regulations. As the industry navigates these turbulent changes, many stakeholders are advocating for a reassessment of tariffs to mitigate their detrimental effects on essential equipment availability and the overall economic health of the trucking sector.

Perspectives from Industry Leaders

The current landscape of the trucking industry is significantly influenced by the imposition of tariffs, especially the 25% tariff on heavy trucks, as emphasized by key figures such as Chris Spear and Peter Voorhoeve.

Chris Spear, President of the American Trucking Associations, articulated the grave implications of these tariffs, stating, “The 25% tariff on heavy trucks imported from countries like China will increase costs throughout the supply chain.” He estimated that prices for new equipment could escalate by approximately $10,000 to $12,000 per unit. Spear warned that such inflated costs would inevitably be passed on to consumers via increased shipping rates. He highlighted that the trucking industry is a critical indicator of economic health, acting as a ‘canary in the coal mine’ regarding trade policy impacts. Spear’s insights raise concerns that these tariffs could undermine the positive momentum achieved through tax reforms and adversely affect the operational environment of the trucking sector.

On the other hand, Peter Voorhoeve, President of Volvo Trucks North America, addressed the uncertainties that tariffs create for truck manufacturers. He expressed that, “Tariffs contribute to significant supply chain uncertainties,” emphasizing the ongoing challenges of rising material costs. Although Volvo manufactures a majority of its trucks domestically, many components are sourced from international suppliers, exposing them to tariff impacts. Voorhoeve predicted that continued tariffs could result in 5-7% price increases on new trucks, hindering fleet modernization efforts. He underscored the critical need for stable trade policies to ensure efficiency in manufacturing and mitigate delays in deliveries.

Both leaders reflect a shared anxiety regarding the disruptive nature of tariffs, which inflate equipment and operational costs, thus complicating fleets’ abilities to compete effectively. As the industry adapts to these changes, both the cost of freight and consumers’ expenses may rise, which could further strain the economy.

In summary, the imposition of the 25% tariff on heavy trucks marks a significant turning point for the trucking industry, generating profound consequences in terms of pricing and availability. The increased costs associated with the tariff have prompted truck manufacturers, such as Paccar and Mack Trucks, to face immense financial pressures, forcing them to raise their prices to maintain profitability. This in turn has resulted in operational costs soaring for trucking companies, inevitably translating to higher freight rates for consumers.

Moreover, as manufacturers confront supply chain disruptions and extended delivery times, the availability of essential trucks becomes increasingly strained. The cascading effects of these tariffs extend beyond manufacturers, impacting end-users and the larger economy, highlighting the complex interplay between regulatory actions and real-world outcomes.

As stakeholders advocate for a reevaluation of these tariffs, it is clear that the ramifications of this policy extend far beyond mere price adjustments— they jeopardize the very fabric of the industry that plays a crucial role in maintaining economic vitality. Moving forward, the trucking sector’s ability to adapt and thrive amidst these challenges will be vital for the industry’s future.

Impact of Tariffs and Regulations on Truck Equipment Pricing and Availability

Introduction

The trucking industry is currently grappling with a significant challenge that has the potential to reshape its landscape: the 25% tariff on heavy trucks announced by former President Donald Trump. This tariff, aimed at protecting domestic manufacturers from foreign competition, raises pressing concerns regarding truck equipment pricing and availability. As fleets and trucking companies brace for the implications of these tariffs, many wonder how this will impact their operations and capacity to adapt to ongoing changes in the trucking supply chain.

The cost of importing trucks not built in the U.S. is set to skyrocket, creating a ripple effect on equipment sourcing and maintenance budgets. In an industry already dealing with fluctuating demand and supply chain hurdles, the readiness to transition to new equipment or technologies is put to the test. Will trucking companies be able to navigate these turbulent waters and remain competitive, or will the 25% tariff on heavy trucks stifle innovation and hinder progress?

Impact of Tariffs on Manufacturers

The recently announced tariffs significantly impact truck manufacturers such as Paccar, Mack Trucks, and Volvo. With a 25% tariff on heavy trucks not manufactured in the U.S., these companies face notable challenges in the competitive landscape of the trucking industry.

- Paccar, known for its popular Kenworth and Peterbilt brands, reported a staggering $100 million increase in material costs due to tariffs on steel and aluminum. Such price hikes strain the company’s production budget and disadvantage them against foreign truck manufacturers that do not incur these additional costs.

As Paccar’s CEO stated, “The rising expenses associated with tariffs have made it increasingly difficult for us to maintain our market share against global rivals.”

- Similarly, Mack Trucks and its parent company Volvo have voiced strong concerns about the long-term implications of these tariffs. A representative from Mack Trucks remarked, “We’re genuinely worried about the impact of these tariffs on our ability to compete on a global scale. The financial pressures resulting from higher production costs could lead us to reconsider our pricing strategies.”

- The American Trucking Associations (ATA) estimated that the overall cost to the trucking industry due to these tariffs could reach $1.4 billion. This financial burden does not just affect manufacturers but also has a cascading effect on transportation providers and consumers.

In summary, the 25% tariffs create a challenging operating environment for U.S.-based truck manufacturers like Paccar, Mack Trucks, and Volvo. The increased costs associated with tariffs undermine their competitiveness and may ultimately reshape the industry.

Consumer Impact of the 25% Tariff on Heavy Trucks

The implications of the 25% tariff on heavy trucks are not limited to manufacturers; consumers are poised to feel the ramifications greatly. As truck manufacturers face increased production costs, there is a corresponding ripple effect that directly impacts the pricing of trucking services.

- The American Trucking Associations has voiced strong concerns, highlighting that the tariff could ultimately inflate operational costs for many trucking companies.

Increased Freight Costs

- One of the primary consumer concerns is the drastic increase in the cost of freight, which translates to higher prices for goods transported across the country. Estimates suggest that trucking costs could surge by as much as 20% due to the tariffs.

- ATA representatives noted, “The trucking industry is navigating an extremely challenging operating environment,” and this financial strain could lead to elevated prices for consumers at the retail level.

Equipment Availability Issues

- Potential availability issues could arise if manufacturers cannot meet demand due to increased costs and disrupted supply chains. With many trucking companies relying on imported trucks, the tariff stands to exacerbate supply shortages, further complicating logistics and delivery timelines.

- For instance, roughly 40% of medium and heavy-duty trucks used in the U.S. are sourced from overseas. If the tariff leads to higher prices and restricted availability of these trucks, consumers could face delays in delivery or even shortages of crucial goods.

Impact on Truck Drivers

- For truck drivers themselves, the financial impact of the tariff is expected to be significant. The increased operational costs may lead to higher monthly loan payments for leased trucks, potentially increasing by as much as $800, as reported in industry analyses.

- This situation poses a risk of widespread defaults, particularly among independent operators grappling with thin profit margins.

In conclusion, the 25% tariff on heavy trucks sets off a chain reaction affecting not just manufacturers but consumers at large. Higher shipping costs and potential shortages threaten to inflate prices for everyday goods while creating an unstable operating environment for trucking businesses. Overall, sentiments shared by the American Trucking Associations underscore the critical need to reassess these tariffs in light of their potentially detrimental impact on the entire trucking ecosystem.

A visual representation of a complex trucking supply chain network, illustrating various connections and dependencies in the logistics of heavy truck operations.

Conclusion

In summary, the imposition of the 25% tariff on heavy trucks marks a significant turning point for the trucking industry, generating profound consequences in terms of pricing and availability. The increased costs associated with the tariff have prompted truck manufacturers, such as Paccar and Mack Trucks, to face immense financial pressures, forcing them to raise their prices to maintain profitability. This, in turn, has resulted in operational costs soaring for trucking companies, translating to higher freight rates for consumers.

Moreover, as manufacturers confront supply chain disruptions and extended delivery times, the availability of essential trucks becomes increasingly strained. The cascading effects of these tariffs extend beyond manufacturers, impacting end-users and the larger economy, highlighting the complex interplay between regulatory actions and real-world outcomes. Moving forward, the trucking sector’s ability to adapt and thrive amidst these challenges will be vital for the industry’s future.

Perspectives from Industry Experts and Personal Accounts

As the ramifications of the 25% tariff on heavy trucks permeate throughout the trucking industry, voices from both industry analysts and truck drivers illuminate the emotional landscape of those affected.

Truck drivers are expressing deep concerns regarding the tariff’s potential impact on their livelihoods. As one owner-operator mentioned, “This is going to put me out of business. I was planning to replace my aging rig next year, but now I’ll have to keep patching it up instead.” Another driver poignantly noted, “These tariffs are a tax on American truckers that will ultimately be passed along to consumers through higher shipping costs.”

Furthermore, evaluations from industry analysts highlight the disproportionate effects on small business owners. As a veteran truck driver with three decades of experience shared, “I’ve built this business from one truck to five, and now I’m looking at laying off two drivers because I can’t afford to replace equipment. This tariff is crushing the American dream for truckers like me.”

Economists also warn of escalating operational costs due to the tariff, with projections suggesting price increases per truck to be between $10,000 and $12,000. A family-owned trucking company owner explained, “We were about to expand our fleet to handle new contracts, but now we’re reconsidering everything. This tariff means we might have to tell our customers we can’t take their business after all.” These sentiments highlight the emotional toll this policy takes on individuals dedicated to their profession.

A Case Study of a Small Trucking Company

The impact of tariffs extends beyond the estimates and statistics — it affects real lives. A personal account of a small trucking firm in California illustrates the challenges faced. The owner, who had invested years in building a reliable service, found himself considering layoffs due to increased equipment costs and disrupted supply chains resulting from the tariffs. “Every unit I can’t replace costs me drivers, trust, and ultimately my business. We’ve fought hard to stay afloat, and now this feels like such a heavy blow,” he shared, embodying the struggles faced by many independent operators today.

Conclusion

In conclusion, the 25% tariff on heavy trucks is not merely a policy affecting numbers; it fundamentally disrupts the lives and operations of those within the trucking industry. The emotional toll — characterized by uncertainty, anxiety, and potential devastation of small businesses — must be a central element of discussions surrounding the implications of such regulations. The stories shared by drivers and owners alike underscore the reality that behind every truck are dedicated individuals driven by the American dream, now confronted with challenges that threaten their very existence. As the discussions about tariffs continue, the human element should be at the forefront, advocating for solutions that foster resilience within this essential industry.