Embarking on the journey of owning a food truck is as thrilling as it is daunting. The excitement of bringing your culinary vision to life on wheels, serving up delicious food to eager customers, is unparalleled. However, along with this exhilarating experience comes the responsibility of managing your finances effectively. Understanding the ins and outs of budgeting and financial management is essential for first-time truck owners.

This adventure requires a positive mindset, where preparation meets creativity, ensuring that every expense is accounted for and every dollar is wisely spent. By cultivating a practical approach to financial planning, you will not only navigate the challenges ahead but also enjoy the satisfying rewards of your hard work in the vibrant world of food vending.

Initial Financial Responsibilities for New Truck Owners

Owning a food truck is a rewarding venture but comes with its set of financial responsibilities. Here are the initial costs new truck owners typically face:

- Cost of the Truck: Depending on size, condition, and customization options, new food trucks can range from $20,000 to over $100,000.

-

Permits and Licenses: Owners need to secure multiple permits, which can cost anywhere from $100 to $2,000 annually, heavily influenced by local regulations. This includes:

- Business licenses: $50 to $400 annually.

- Health department permits: $100 to $1,500.

- Fire safety certificates: $25 to $500.

- Insurance: New food truck operators are required to invest in various types of insurance, including general liability and vehicle insurance, which can range from $2,000 to $4,000 per year.

- Maintenance Costs: Regular maintenance is crucial for keeping the truck operational. Costs can include oil changes, brake inspections, and tire replacements, which together may tally up to $1,200 to $2,000 annually.

- Operational Costs: These include fuel, utilities, staffing, and food supplies. Fuel expenses can vary greatly with seasonal fluctuations, making up a substantial part of ongoing operational budgets.

Preparing for these financial responsibilities is vital in ensuring the long-term viability of the food truck business.

Related Facts

- Routine maintenance includes costs like oil changes and brake inspections.

- Insurance costs depend on coverage type, vehicle model, and driving record.

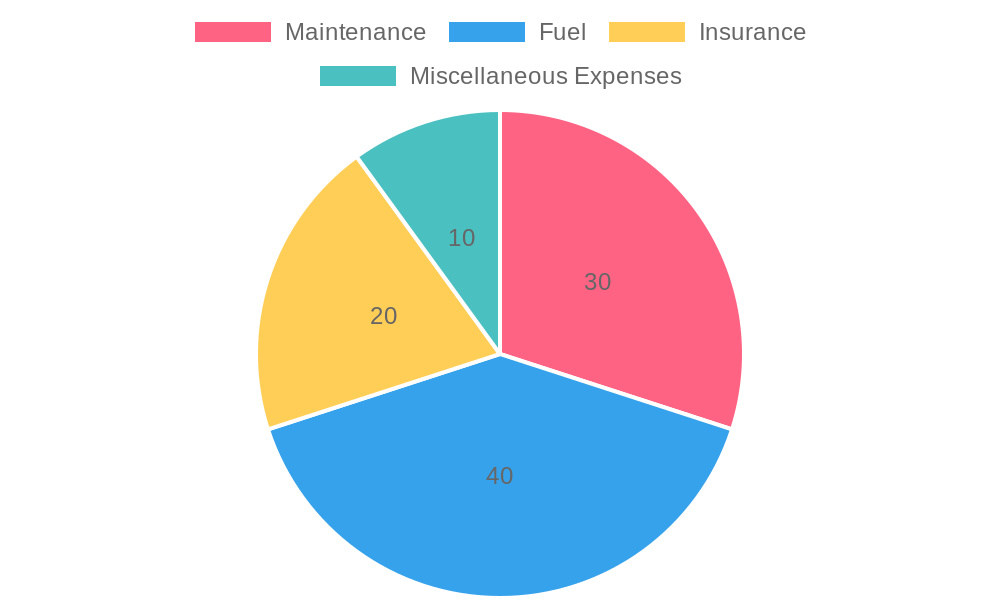

| Expense Type | Estimated Monthly Cost |

|---|---|

| Fuel | $300 – $800 |

| Insurance | $200 – $350 |

| Maintenance | $100 – $300 |

| Registration Fees | $50 – $150 |

| Miscellaneous Repairs | $200 – $500 |

Note: Monthly costs may vary depending on your location, truck size, and operational schedule.

Ongoing Expenses for Food Truck Owners

Once the excitement of launching a food truck subsides, owners quickly realize that the financial commitments extend well beyond initial purchases. Ongoing expenses are significant factors in the management of a food truck business.

Routine maintenance is one of the major ongoing costs. This includes everything from oil changes and filter replacements to brake inspections that collectively can range from $100 to $300 monthly depending on the truck’s condition and usage. Regular upkeep can help prevent more expensive repairs down the road, making it an essential part of financial planning. As one experienced truck owner suggests, “Routine maintenance isn’t just an expense; it’s an investment in the longevity of your business.”

Insurance is another critical, yet variable, expense. Depending on factors such as coverage levels, the type of truck, and the owner’s driving history, insurance costs can range from $200 to $350 monthly. Different states may have varying regulations that also impact insurance rates. This is an area where budgeting becomes key, as it’s crucial to have adequate coverage to protect the business while managing costs effectively.

Tires can also add to a food truck owner’s expenses. Due to the wear and tear that comes from constant movement and the weight of the equipment and supplies, tire replacements are often necessary. This could mean a significant one-time payment that subsequently influences monthly budgets. Some estimates suggest that tire replacement costs alone may add up to $800 to $1,200 each year depending on how frequently they need to be replaced and the quality of the tires selected.

These ongoing costs can have a substantial impact on monthly budgets. Proper planning and allocation of funds towards these expenses help prevent cash flow issues. As an expert in financial management states, “Budgeting for both predictable and unpredictable expenses ensures that owning a truck remains practical and enjoyable.”

In conclusion, food truck owners must stay vigilant of these ongoing expenses to maintain a healthy financial status and enjoy the rewarding aspects of their culinary endeavors.

Conclusion

In summary, successfully managing finances as a food truck owner involves several key strategies that can significantly influence your business’s sustainability and growth. Preparation is paramount; understanding the financial responsibilities that come with owning a food truck helps you set realistic expectations and navigate the industry’s complexities.

Creating an emergency fund is another critical aspect of financial planning. This fund acts as a safety net for unforeseen circumstances, such as unexpected repairs or seasonal fluctuations in sales, ensuring that your food truck can weather both minor inconveniences and major challenges without compromising your operations.

Moreover, budgeting wisely for both predictable and unpredictable expenses is crucial. This means accounting not just for regular costs like fuel and insurance but also preparing for potential emergencies. As experienced food truck owners have often noted, budgeting effectively enables you to maintain control over your financial reality, transforming unpredictability into stability.

By embracing these financial strategies—preparation, establishing an emergency fund, and thorough budgeting—you position your food truck for success, allowing you to focus on your culinary passion while keeping your finances in check. Remember, the journey of owning a food truck can be rewarding and enjoyable when approached with the right financial practices in mind.

The Importance of Financial Planning in a Food Truck Business

Financial planning is vital for the success and sustainability of a food truck business. Proper financial management can make the difference between thriving in a competitive market and facing unforeseen hardships. Below are some key components that highlight the importance of financial planning in this industry:

- Creating a Comprehensive Budget: A well-thought-out budget serves as the backbone of your financial strategy, helping you allocate funds wisely across various expenses. It is crucial to include:

- Startup costs (truck purchase, permits, equipment).

- Ongoing operational costs (fuel, maintenance, staffing).

- Emergency expenses to prepare for the unexpected.

- Considering Resale Value: When purchasing a food truck, it’s essential to think about its future resale value. A robust financial plan involves:

- Keeping the truck in good condition through regular maintenance.

- Choosing a well-regarded brand with a strong market presence to enhance resale prospects.

- Recognizing that the resale value can serve as a financial cushion when deciding to upgrade or exit the business.

- Establishing an Emergency Repair Fund: Every food truck operator should maintain an emergency fund specifically for repair costs. This contingency allows you to:

- Address mechanical failures or accidents without disrupting your cash flow.

- Survive downturns in sales due to equipment issues, ensuring continuous operations even in challenging times.

- Mitigate the impact of unpredictable costs on your overall financial health.

In conclusion, prioritizing financial planning not only promotes sound decision-making but also ensures long-term health for your food truck business. By creating a budget, considering the resale value of your assets, and maintaining an emergency fund, you can navigate the complexities of the industry and position yourself for sustained success.

Common Financial Pitfalls for First-Time Food Truck Owners

Starting a food truck business can be thrilling, but first-time owners often face common financial pitfalls that can threaten their success. Recognizing these mistakes and implementing strategies to avoid them can significantly enhance your chances of thriving in the competitive food truck market. Here is a summary of the most prevalent financial missteps along with practical tips to navigate them:

-

Underestimating Startup and Operating Costs

New truck owners frequently overlook the full range of expenses associated with their business. From the purchase price of the truck to licenses, permits, insurance, equipment, and initial inventory, costs can escalate quickly. For example, startup expenses can range from $50,000 to over $150,000.Tip: Develop a comprehensive business plan that details all potential expenses, including hidden costs. Set aside an emergency fund to cover unexpected expenses.

-

Poor Cash Flow Management

Many new owners fail to effectively manage cash flow, focusing solely on revenue without tracking daily expenses. This can lead to cash shortfalls.Tip: Implement cash flow forecasting to help anticipate needs, and regularly monitor daily sales and expenses to understand spending patterns.

-

Mixing Personal and Business Finances

Confusing personal and business finances can complicate bookkeeping and obscure the true financial health of the business.Tip: Open separate bank accounts for personal and business transactions. This clarity simplifies accounting and helps you better assess your business’s performance.

-

Overcomplicating the Menu

A broad menu can lead to increased costs and food waste, while also complicating service and brand identity.Tip: Focus on a select few signature dishes that represent your culinary strengths. This approach can streamline operations and build a stronger brand.

-

Neglecting Marketing Efforts

Assuming that great food alone will attract customers can be a costly misconception.Tip: Use social media platforms effectively to engage with customers and announce your location, menu specials, and events to maintain visibility.

-

Ignoring Licensing and Health Regulations

Non-compliance with local regulations can result in fines or business shutdowns.Tip: Research all necessary licenses and health codes before starting operations to ensure compliance.

-

Inadequate Location Planning

Choosing a poor location can dramatically impact sales due to low foot traffic or high competition.Tip: Conduct thorough market research to find high-traffic areas and consider participating in local festivals or events.

-

Overlooking Equipment Quality

Opting for low-quality equipment may save costs initially but can lead to frequent breakdowns and lost revenue.Tip: Invest in reliable equipment that suits the demands of daily operations to avoid future expenses related to repairs.

-

Failing to Plan for Growth

Lack of a long-term vision can limit business potential.Tip: Formulate a business plan that incorporates growth strategies, such as exploring new markets or adding more trucks as the business expands.

By proactively addressing these common financial pitfalls, first-time food truck owners can create a sturdy foundation for a successful and sustainable business model.

Seasonal Financial Considerations for Food Truck Owners

Managing a food truck business comes with its share of challenges, and seasonal fuel variations are among the most significant. These fluctuations, influenced by factors such as seasonal demand, geopolitical issues, and local market conditions, can significantly impact budgeting for food truck owners. Understanding these variations and developing strategies to manage costs effectively is crucial for maintaining profitability year-round.

Impact of Seasonal Fuel Variations

Fuel prices can vary widely throughout the year, often peaking in the summer when demand surges due to increased travel and outdoor events. For instance, the transition from winter to summer fuel blends can temporarily disrupt supply and lead to unpredictable price increases. On the other hand, winter fuel may contain additives that can raise costs during colder months. By being aware of these fluctuations, food truck owners can better prepare their budgets to absorb these cost changes.

Strategies for Managing Costs Across Seasonal Fluctuations

-

Forecasting Fuel Costs:

A proactive approach to budgeting begins with analyzing historical fuel prices. By examining past trends, food truck owners can anticipate seasonal spikes and adjust their financial planning accordingly. For example, if you notice that prices tend to rise in June each year, you can allocate extra funds in advance.

-

Establishing a Reserve Fund:

Consider setting aside a percentage of your revenue during slower months to create a fuel reserve fund. If you save about 5% of revenue during the fall, for example, you can use these savings to cover increased fuel costs in the summer, minimizing cash flow disruptions.

-

Optimizing Routes and Schedules:

Analyze and adjust your operating routes based on seasonal demand. In the summer, you might extend your operating hours to attract evening crowds at local events, taking advantage of higher foot traffic without incurring excessive fuel costs. Conversely, during the winter, reevaluating your schedule to focus on peak times can reduce unnecessary fuel expenses.

-

Regular Vehicle Maintenance:

Keeping your food truck in top condition can enhance fuel efficiency. Regular maintenance, such as checking tire pressure, changing air filters, and tuning the engine, can help ensure you are getting the most out of every gallon. A well-maintained truck will perform better, especially under the seasonal demands of summer or the harsher conditions of winter.

-

Adjusting Pricing Strategies:

Should fuel prices spike unexpectedly, consider a temporary price adjustment for your menu items. Communicate transparently with your customers about rising operational costs, which can help maintain trust while keeping your business profitable. For instance, if you anticipate a summer fuel price increase, consider incorporating slight price elevations a few weeks in advance to cushion your profit margins.

Example of Successful Management

One example of effective cost management comes from a small food truck owner in California who forecasts fuel prices by researching seasonal trends. By maintaining a well-organized reserve fund and adjusting operating hours to high-traffic locations during summer festivals, they manage to offset high fuel expenditures and continue to yield profits even amid fluctuating costs.

In summary, understanding how seasonal fluctuations in fuel prices affect the food truck industry provides an opportunity for proactive financial management. By implementing effective budgeting strategies and making informed operational decisions, food truck owners can navigate the challenges posed by these variations and work towards sustained profitability throughout the year.